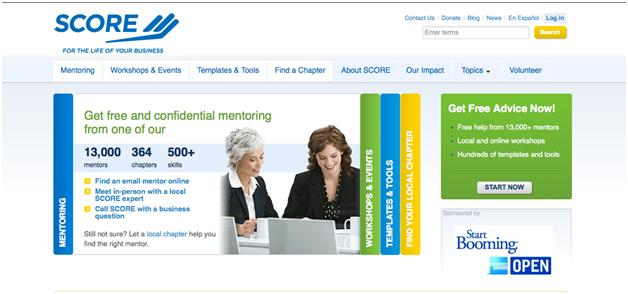

SCORE is a non-profit organization that provides help for small business owners looking for growth or entrepreneurs looking to start up their new business. The organization claims to ‘grow successful small businesses across America’. Operating since 1964, the organization provides free or inexpensive services to businesses at all hours of the day. In less than 50 years, the organization has grown to include 365 local chapters and has a network of more than 13,000 volunteer mentors.

SCORE is a free small business advice forum that provides online or face-to-face counseling to business owners, arrange local workshops and online seminars and provide them with free business tools and templates. The organization is supported by the U.S. Small Business Administration and sponsored by conglomerates like Google, Microsoft, Visa, Bank of America and The Wall Street Journal.

Why Use SCORE?

You cannot start up a new business without having sound advice from someone who has practical experience of business management. Usually, you can go for this advice to any number of marketing experts but you will have to pay a hefty price they charge. If you have sufficient start-up capital, you can opt for it but for small businesses with limited capital, this is definitely not feasible.

So, for all those business owners who cannot afford to go for priced advice, SCORE offers a perfect platform. SCORE has a number of business executives, working or retired, working as volunteer small business advisors round the clock. These advisors provide you with advice regarding any of your business concern for free.

The best part is that these people help you because they are passionate about their work, not because they are obligated to it. This results in high involvement on their part and a concern over your success. They dedicate a sufficient amount of time and effort to your business. In the end, you have everything to gain and nothing to lose.

Is it Just Advice you can get?

It is not just business advice that you get at SCORE, but a lot more practical help for your business. SCORE experts also offer you help with the use of different business tools. Whether you are looking to improve your business plan, create marketing strategies or revise your budget, SCORE experts can help you with it. A whole section of templates is dedicated to business planning and management.

Another remarkable service offered by SCORE is conducting free workshops at their local chapters throughout the U.S. These workshops provide a chance for people to share their experiences and initiate queries. If you cannot reach a local chapter easily, there are a number of online workshops and seminars present on their site 24/7.

A number of volunteer mentors are also available. A mentor will not only give you advice but help you with your business practices. They help small businesses to start and grow over the years in tough times. For small businesses the site can be a comprehensive guiding platform where they can get a solution for all their problems, without paying a cent.

How to Reach Them?

Access to SCORE.org is the easiest thing to do in your entire business start-up process. All you have to do is visit their website. The website is easy to use, quickly navigated and give clear instructions about its different sections. A link to the sitemap is provided at the bottom of homepage which can further guide you about the content on the website. It is a great resource for entrepreneurs who want to start a new small business or needs help and advice regarding an existing business.

Testimonials

The site has a long list of positive customer testimonials. Laura Dessauer, Owner of Creativity Queen says,

“What I learned from SCORE continues to help me make it through the recession. With the help of SCORE I am positioning my business to triple my earnings from last year.”

Summary

If you are looking for advice about any concern regarding your business start-up, SCORE is the place you need to visit. SCORE is the biggest business counseling organization that provides free services. It guides entrepreneurs to set up their business and make it grow and flourish over the time. You can get all the help you need about managing a small business successfully from experienced executives.

Do visit and check it out, it is completely free!